Navigating Bitcoin's Volatility: Why You Shouldn't Sell

Written on

Chapter 1: Understanding Bitcoin's Appeal

This article is aimed at those fortunate enough to have purchased Bitcoin in 2020 or 2021, who may now feel uncertain about their investment. Many of my friends fit this description lately.

If you jumped in when Bitcoin was around 50K, you likely did so because the buzz around it was everywhere, and you didn't want to miss the chance to profit or achieve financial freedom during a pandemic.

Bitcoin hit a peak of social media hype in February 2021, largely thanks to Elon Musk, who contributed to the influx of 2 million new Bitcoin wallet users that year, boosting the coin’s popularity.

Initially, the surge was unnoticed by many, as the seasoned investors had been waiting for this moment for nearly two crypto winters. The early stages of a Bitcoin bull run can feel like a secret dance; few are watching while you partner with a thrilling new asset.

However, once Bitcoin reaches a significant price point, it captures the attention of a wider audience, igniting excitement and hype. Then, as quickly as it rose, prices start to fall. The pressing question becomes: should you hold your position or cut your losses?

Are you willing to trust the process and stay the course, or will you opt to exit quickly, hoping to salvage some of your investment for a riskier venture?

Here are three compelling reasons to remain committed to Bitcoin, and to be patient for the next exhilarating phase of this financial dance.

Why Bitcoin is More than a Quick Fix

Before we delve into some eye-opening data, let’s briefly clarify what Bitcoin actually represents.

Consider this:

- Bitcoin has been the top-performing asset over the last decade.

- It serves as a revolutionary form of currency that aims to disrupt our traditional financial systems.

- Bitcoin has evolved from a tool for illicit transactions to a secure option for those in countries facing hyperinflation.

- The Bitcoin network boasts over 10,000 nodes, forming a decentralized blockchain that validates transactions worldwide.

- It is the subject of countless YouTube videos each day discussing price predictions.

- Bitcoin challenges the flawed traditional financial system, where inflation erodes the value of your money.

The Historical Context of Bitcoin

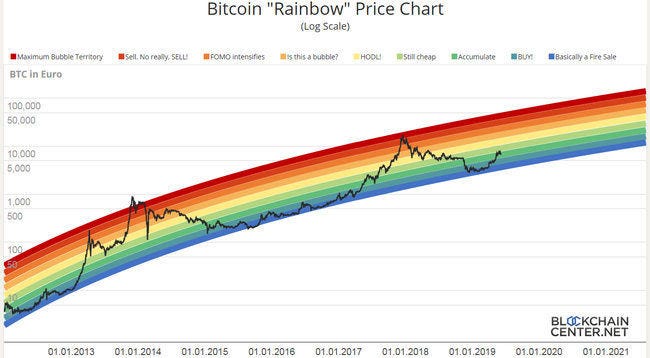

Now let’s look at a chart that’s sure to impress. This chart has often been used to convince skeptics that all you need to do is take a step back and look at the bigger picture. While Bitcoin’s short-term price swings may seem alarming, they obscure a long-term upward trend.

Key metrics suggest Bitcoin could reach a price of half a million dollars. I will highlight two: the Stock-to-Flow Ratio linked to Bitcoin's halvings and historic price movements.

The Rainbow Price Chart is a straightforward visual representation.

I’ve been using this chart since mid-2019 when Bitcoin was around $6k. Interestingly, if you mark the chart at the start of 2021, you'll find the projected peak lies between $50k and $100k. Despite the current pullback, there’s a strong possibility Bitcoin will hit the $100k mark this year, a prediction made when BTC was valued at just $6k.

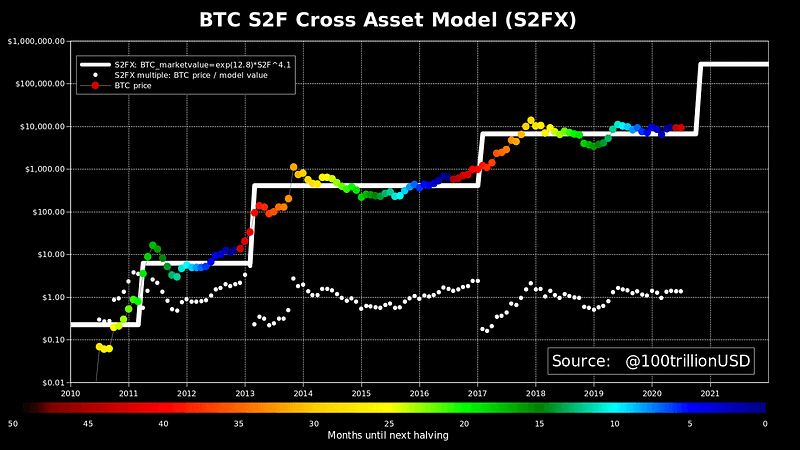

Let’s conclude this brief lesson on Bitcoin charts with the Stock-to-Flow metric. This metric evaluates Bitcoin’s historical strength based on the maximum supply of 21 million coins against its production rate.

Without complicating matters, let’s dive into the chart:

This chart suggests Bitcoin's price could rise to between $300k and $500k in the next three years. For more insights on the Stock-to-Flow model, refer to the live chart and the article that discusses Bitcoin’s scarcity value.

It's essential to remain calm through these fluctuations.

Maintaining Your Commitment During Corrections

In any relationship, one partner will often correct the other. So when your partner reminds you to pick up after yourself, you wouldn't simply pack your bags and leave, right? The same principle applies to Bitcoin.

Keep in mind that Bitcoin is a relationship filled with both allure and risk. Its price can swing dramatically, and it tends to correct itself frequently, influenced by various factors, including market influencers.

If you find yourself in a position where the price drops after your initial investment, remember this: historically, Bitcoin’s value has consistently increased over time. The price corrections are part of the journey.

A price dip of $300 was once major news, whereas now, significant movements, such as an $8K surge triggered by Elon Musk, leave many investors astonished.

To further illustrate this, let's review the corrections from the last bull market leading to the $20K peak in December 2017.

This chart reveals that Bitcoin bull market corrections ranged between 29% and 38%. The previous run-up had six corrections.

Fast forward to the latest market data: After breaking the previous all-time high of $20K on December 16, 2020, Bitcoin quickly rose to nearly $42,000 by January 8, 2021, before experiencing a sharp decline to $31,000—a 26% loss. The corrections continued, reaching $28K on January 22, marking a total drop of $14K, or 30%.

Similarly, following the most recent all-time high of $60K, Bitcoin fell to $43K by February 28, representing a decrease of $17K (28.3%).

In other words, if you bought in at $50K and panicked, selling at $43K, you risk missing a potential rise above $60K, possibly even reaching the $100K mark by year’s end.

The Future of Bitcoin

For many seeking real change in the world, Bitcoin symbolizes a future of financial freedom. It represents a new form of value exchange, promoting financial equality and inclusion.

However, it's crucial to recognize that entering the Bitcoin market can feel like embarking on a rollercoaster ride. The volatility may be intimidating, but this piece has outlined why it’s essential to hold your ground and stay focused amidst the turbulence.

Like any dance, the timing of highs and lows is unpredictable, but the music never stops. Major corrections can be disheartening, but don’t let them shatter your confidence. Hold your position and continue your journey into uncharted price territory.

Lucien Lecarme

Earn passive income with Crypto? Check out my DeFi beginner's course. And why not subscribe to my free weekly insights on Substack?

The information provided here is not financial advice; Bitcoin is my passion.

Chapter 2: Insights from Recent Bitcoin Videos

The first video titled "Bitcoin Is Collapsing | Here's What You Need To Know" explores the current state of Bitcoin and the implications for investors.

The second video, "Is The Bitcoin Sell-Off Over...Or Just Getting Started?" delves into the ongoing sell-off and what it means for the future of Bitcoin.